Charitable Remainder Annuity Trust

You want the flexibility to invest and manage your gift plan, and also the security of stable income.

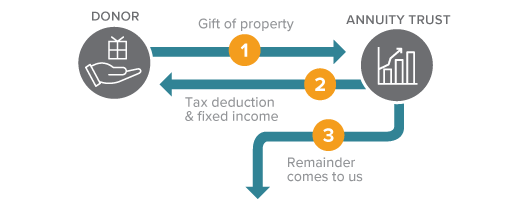

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to Sisters of Notre Dame de Namur Ohio Province to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.

Next

- Frequently asked questions on Charitable Remainder Annuity Trusts.

- Related Gift: Charitable Remainder Unitrust.

- Contact us so we can assist you through every step.

With you, we change lives

With the support of generous friends like you, we are able to continue our mission of educating and taking a stand with the poor — especially women and children.

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.