Charitable Gift Annuity

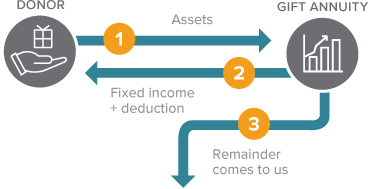

A charitable gift annuity is a simple agreement between you and Sam Houston State University. In exchange for a gift of cash or appreciated assets, you receive fixed payments for life.

How It Works

- You transfer cash or securities to Sam Houston State University. Our minimum gift requirement is $10,000.

- SHSU pays you, yourself and a spouse, or any two beneficiaries you name, fixed payments for life.

- Beneficiaries are recommended to be at least 65 years of age at the time of the gift.

- The remaining balance passes to SHSU when the contract ends.

- You can also create a life income gift through your IRA. Discover more here.

Benefits

- Receive more income for your money because of higher rates.

- Receive dependable cash-flow for life, regardless of fluctuations in the market.

- In many cases, receive payments at a rate higher than the interest you are currently receiving on investments.

- Receive an immediate income tax deduction for a portion of your gift.

- A portion of your annuity payment will be tax-free for a number of years.

- Are you a younger donor? Consider a deferred gift annuity.

Next

- More detail on Gift Annuities.

- Frequently asked questions on Gift Annuities.

- Contact us so we can assist you through every step.