Charitable Gift Annuity

A charitable gift annuity is a simple agreement between you and the Community College of Baltimore County. In exchange for a gift of cash or appreciated assets, you receive fixed payments for life.

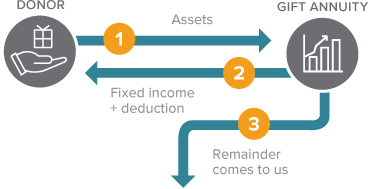

How It Works

- You transfer cash or securities to the Community College of Baltimore County. Our minimum gift requirement is $10,000.

- CCBC pays you, yourself and a spouse, or any two beneficiaries you name, fixed payments for life.

- Beneficiaries are recommended to be at least 65 years of age at the time of the gift.

- The remaining balance passes to CCBC when the contract ends.

- You can also create a life income gift through your IRA. Discover more here.

Benefits

- Receive more income for your money because of higher rates.

- Receive dependable cash-flow for life, regardless of fluctuations in the market.

- In many cases, receive payments at a rate higher than the interest you are currently receiving on investments.

- Receive an immediate income tax deduction for a portion of your gift.

- A portion of your annuity payment will be tax-free for a number of years.

- Are you a younger donor? Consider a deferred gift annuity.

Next

- Frequently asked questions on Gift Annuities.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.